Did The W4 Form Change For 2024 – If too much is withheld, you will generally be due a refund. “Complete a new Form W-4 when changes to your personal or financial situation would change the entries on the form. For more . Filing your taxes doesn’t just involve filling out all the boxes but also making sure you are keeping track of what is being withheld from your paycheck for the 2023 tax year and what you now owe .

Did The W4 Form Change For 2024

Source : www.patriotsoftware.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

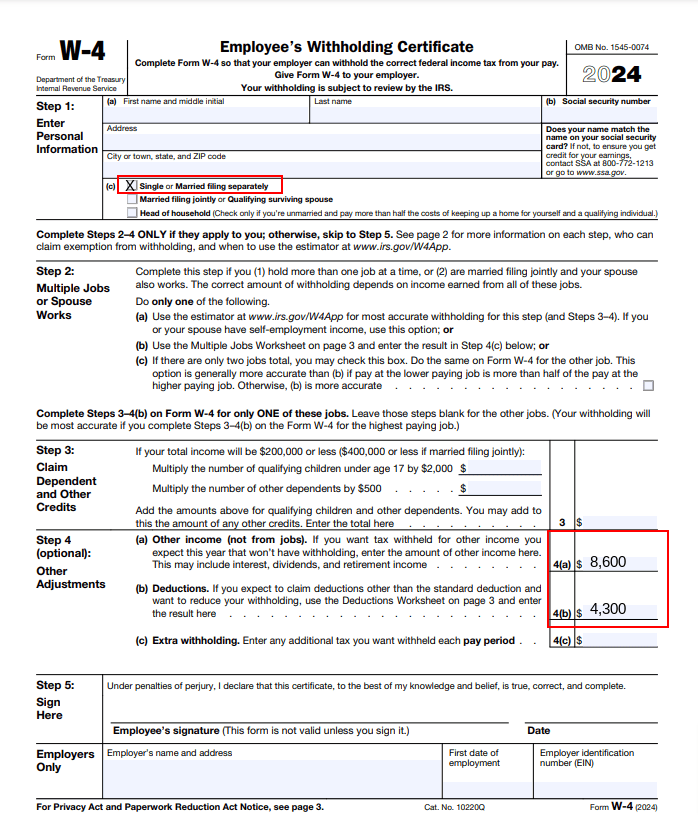

Source : gusto.comEmployee’s Withholding Certificate

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comWhat is a W 4 Form? How to Fill it Out & 2024 Changes

Source : www.goco.ioHow To Fill Out an IRS W 4 Tax Form in 2024 | Indeed.com

Source : www.indeed.comDid The W4 Form Change For 2024 2024 New Federal W 4 Form | What to Know About the W 4 Form: The most common reason why taxpayers end up owing money to the IRS is because they did not have enough money taken out of their paychecks throughout the year, according to tax experts. . Anyone who expects to owe $1,000 in taxes after taking into account any withholding and refundable what was new for you in 2023. Did a marriage or divorce change your filing status and the .

]]>